Review Rabbit Finance Project

Leveraged yield farming by the people,for the people

◾ WEBSITE ◾ TWITTER ◾ TELEGRAM GROUP ◾GITHUB ◾ DISCORD ◾ WHITEPAPER ◾ CONTRACTS ◾ AUDIT ◾

Read News About Rabbit Finance On :

@cz_binance @FinanceRabbit #BSC #BinanceSmartChain #BNB #YiledFarming #Yield Farm #LeveragedYieldFarming #ALPACA #ALPHA #AlphaFinance #AlpacaFinance #badger #BadgerFinance

What is Rabbit Finance?

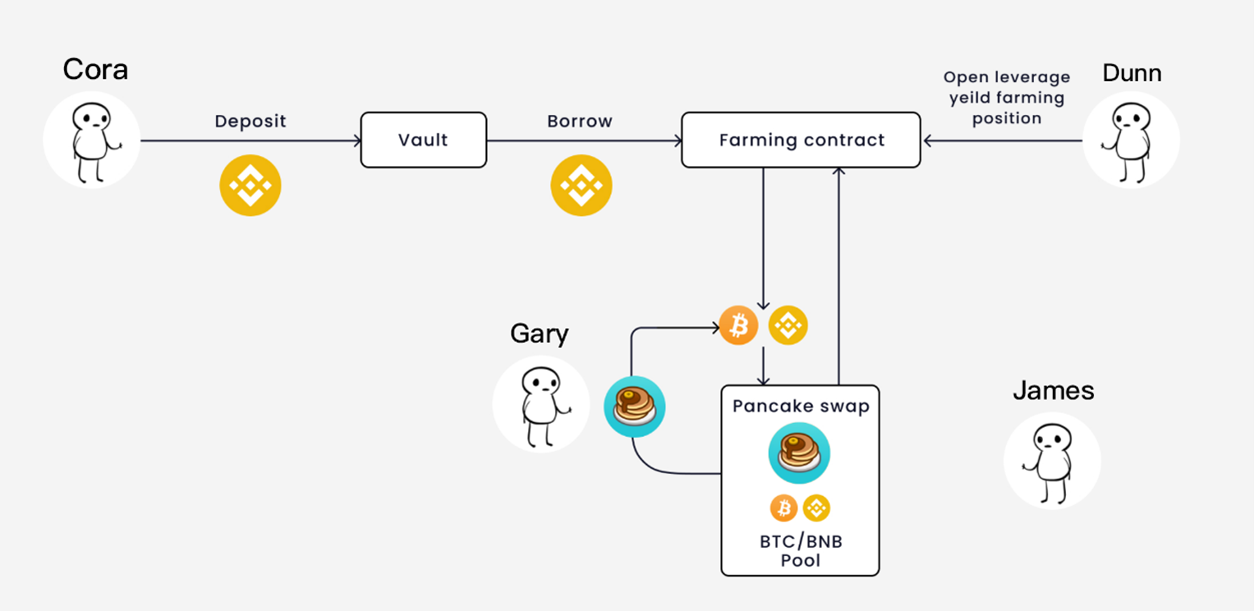

Rabbit Finance is a leveraged yield farming protocol based Binance Smart Chain (BSC) released by Rabbit Finance Lab. It supports users participating in liquidity farming through over-lending plus leverage to get more revenue.

When the user has insufficient funds but wants to participate in DeFi liquidity farming, Rabbit Finance can provide up to 10X the leverage to help users obtain the maximum revenue per unit time, and at the same time provide a borrowing pool for users who prefer stable returns to earn profits.

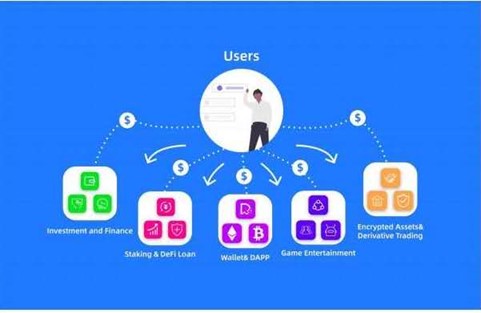

As predecessors of this area like Link, COMP, and BAL are fighting alone, Rabbit Finance, a latecomer, has started to propel resource integration to be the one for all of Defi.

Defi ecology, on the Rabbit Finance, ambitiously included modules like lever gun pool + arithmetic stablecoin, NFT+ arithmetic stablecoin. For Rabbit Finance, they hope to build the Defi ecology through the easy to more advanced and Interlocking combination of functions.

It makes it possible for users to experience the various context of the use of DeFi in a one-stop way, as well as yielding rich returns.

The feature and value of Rabbit Finance

Rabbit Finance provides lever gun pool arithmetic and can support up to 10X the leverage, which means the return of the earnings of the users can be inflated tenfold.

Figuratively speaking, if you are mining in a CAKE/BNB pool, maybe you have your liquid token worth 1,0000 RMB mining in the pool, and the revenue there is 100%. However, via Rabbit, you can borrow extra asset mining in the pool to get 1000% annualized returns(the interests and costs were taken out), this is the most direct way to maximize the revenue.

Of course, same as other levers, if the price trend is at a disadvantage, the risk of clear existing. Even so, you can still borrow USD or BNB from a much safer pool of money and get reasonable annualized returns under lower risks.

On Strategy, Rabbit Finance adds to the mechanism of reinvestment to maximize the users’ earnings. The bounty hunter can act reinvestment at any time and then converts them into the LP tokens for the pool you are farming and compounds them onto your farming principal so you can maximize your APY.

Besides, when the bounty hunter pitches on the pool and executes the reinvestment, 30% of the bounty of the pool is used as buyback funds to promote the value of the token.

Why does reinvestment raise the value of the token? This can be explained by the supply and demand relationship in economics. When the demand exceeding the supply, the value of the asset is bound to raise. According to the deflation mechanism of Rabbit Finance, the 30% of reinvestment earnings is used to repurchase fund to realize the continuous deflation of the token. In the author’ perspective, the deflation mechanism of Rabbit will become the vital factor for realizing the price of token. Continuous buyback and dispose make it possible for the volume of token supply to decline on a limited scale. These will drive the token to be increasingly precious. When Rabbit achieves its implementation, the price of the token is expected to rise correspondingly.

The 30% of the bounty of the pool is used as buyback funds to promote the value of the token. For this service, 0.4% of the bounty pool is directly given to the bounty hunter as a reward, the remaining 69.6% will be converted into LP of the pool and pledged again to obtain compounding returns. The huge power gifted by repeated investment makes it possible for investors to make more profits.

Except for the value increase driven by the token deflation, Rabbit has some other values. For example, before Rabbit coming into being, gun pool tokens can do nothing but to govern. However, Rabbit holders can mortgage their stakes to the board to share bonuses. As long as Rabbit Finance is profitable, its holders are given the right to share the bonus as shareholders and make easy money.

NFT (Non-fungible Token) is an emerging niche market for nearly everyone to take his chance. It is predicted by the specialist that NFT has its potential to become one of the world’s biggest market. The authority of the Rabbit has given much thought to its token. Rabbit Finance Lab will continuously empower Rabbit token, for example, Rabbit holders can snap up irregular issued NFT artwork, and the Rabbit will be automatically locked up during this period. Its circulation will be blocked and its value is expected to be pulled up in a short term. Holding NFT can accelerate mining, empowering the NFT with value with the help of Rabbit.

These two parties are of reciprocal relationships, that is to say, holding Rabbit makes it possible for holders hold NFT, the appreciation of NFT token reacts on the appreciation of Rabbit.

IRO (Initial Right Offering)

Rabbit Finance is now accepting IRO application. IRO means Initial Right Offering. Rabbit Finance is the world’s first decentralized finance project to conduct IRO. You can use BUSD to exchange rRabbit, and earn RABBIT via pledging rRabbit in the revenue pool.

Rabbit Finance provides 5.25% investment quota for well-known institutions and investors. The way to take part in the Institutional Pool is as follows: After completing the form, contact the Telegram admin of Rabbit Finance to apply and obtain permission.

Investors pledge rRabbit in the RABBIT revenue pool, the contract will linearly release RABBIT revenue in 300 days. After the balance is generated, click the CLIAM button to collect it.

What are the RABBIT the rights and interests of IRO?

1)rRabbit/RABBIT-LP liquidity stimulation will be open in due time to give rRabbit abundant liquidity. The proper time is when the revenue is lower than the cost, or after 10 months when rRabbit no longer outputs RABBIT.

2)rRabbit will be gifted with the right to preferentially take part in all kinds of Rabbit Finance orientation programs, for example, the RUSD airdrop or preference to snap up NFT.

When will Rabbit Finance launch?

Rabbit Finance is now accepting IRO application.

The bonus period starts 24th April 12:05 (UTC), open deposit vaults & pancakeswap liquidity pool, emission rate: 42 RABBIT /block. It lasts about 4 days.

Official operation period of leveraged yield farming pool starts 28th April 12:05 (UTC), which will includes followed pools.

Strengths & Vision

Alpaca Finance + Badger Finance

leveraged lending + Yield Farming

Rabbit Finance fully draws on and adopts the advantages of the projects in the market, uses the over leveraged yield farming products with the advantages of Alpaca Finance and Badger Finance. In the whole economic ecology of Rabbit Finance, RABBIT token, which is endowed with more application scenarios, not only represents the governance rights and interests of the leveraged yield farming protocol, but also the shareholders' rights and interests token.

Rabbit Finance believes that the levered yield farming platform will be the next killer application in the field of DeFi after the decentralized exchange and lending platform. They are and will be the most important infrastructure in the DeFi world.

Rabbit Finance's vision is to become the Federal Reserve of the DeFi world, based on the principles of equal opportunity and commercial sustainability, and to provide appropriate and effective financial services at affordable cost for people of all social strata and groups who need financial services. Rabbit Finance is not a simple leveraged yield farming platform. It will be a decentralized and inclusive financial services infrastructure with the ability of continuous hematopoiesis and based on blockchain technology. Compared to being the same role as the Fed, what Rabbit Finance expects goes well beyond The Fed's role in the world economy.

RABBIT Info

What is RABBIT token?

RABBIT token is a governance token of the Rabbit Finance. It will also capture the economic benefits of the protocol. There will be a maximum of 200,000,000 RABBIT token.

What is the RABBIT token used for?

Protocol Governance

We will soon launch a governance vault that will allow community members to stake their RABBIT token. The RABBIT staker will receive xRABBIT where 1 xRABBIT = 1 vote, allowing them to decide on key governance decisionsIn the initial phase, governance decisions will be made on Snapshot.

Obtaining economic benefits such as interest rates and mining income

Lenders can obtain interest returns and RABBIT rewards through deposits, and miners can obtain up to 10 times of mining income and RABBIT rewards by opening leveraged positions.

Increase in the value of RABBIT brought about by continued repurchase and deflation

Rabbit Finance will continue to invest platform revenue for RABBIT repurchase and destruction, which will achieve a deflation of the supply of RABBIT and allow participants to share the benefits of platform growth.

RABBIT distribution

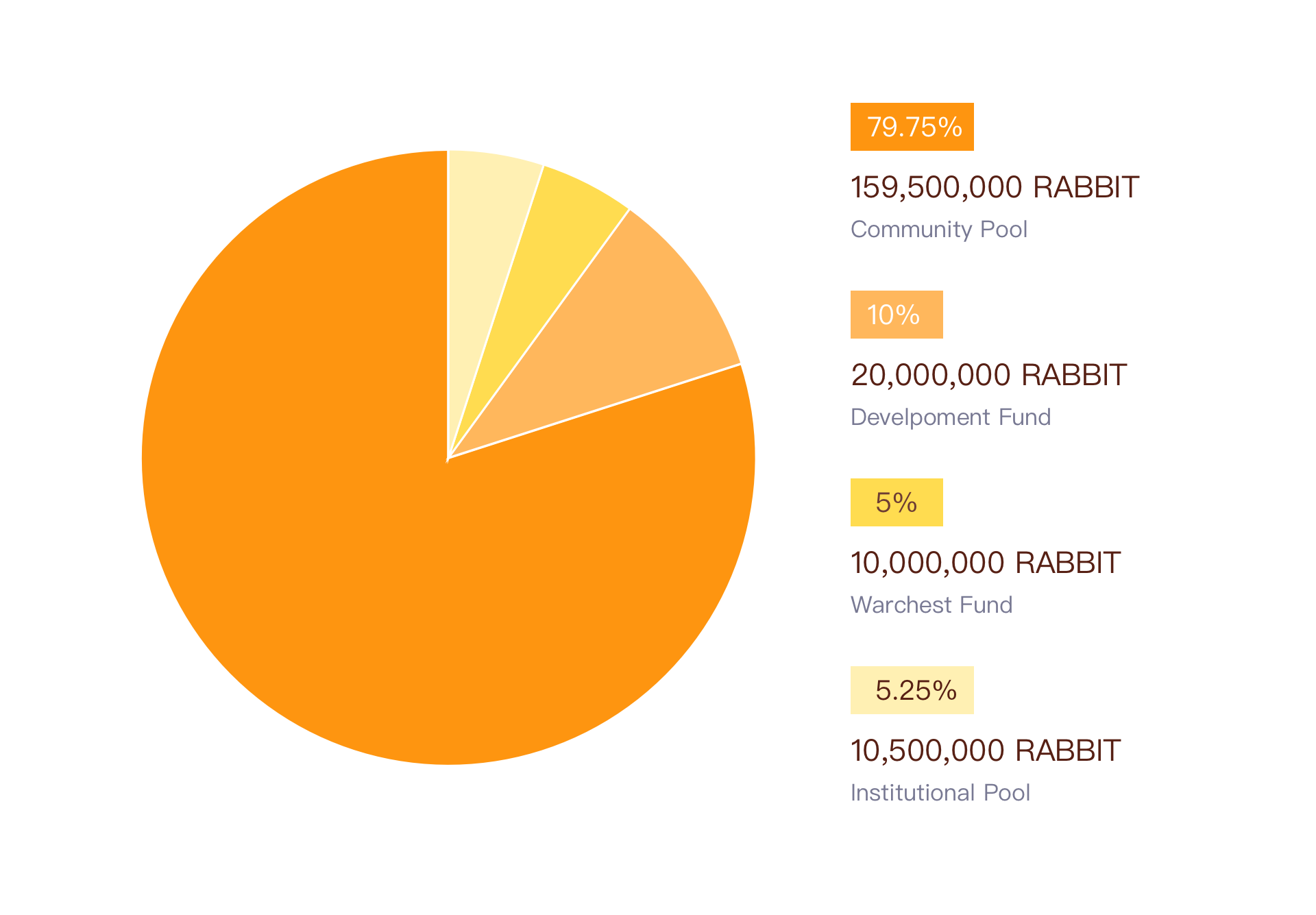

Community Pool

79.75% of total supply,about 159,500,000 RABBIT.

RABBIT will be released over two years with a decaying emissions schedule, and will be evenly distributed to the entire ecosystem as a community reward.

Institutional Pool

5.25% of total supply,10,500,000 RABBIT

Provide 5.25% investment quota for well-known institutions and investors. The direction of how to take part in the Institutional Pool (IRO, Initial Right Offering), please check here. After the completion of the investment, 245,000 RABBIT will be released every 7 days, and 10,500,000 RABBIT will be released within 300 days (about 10 months). Specific time to be determined, please pay attention to the follow-up announcement.

Development Fund

10% of total supply,about 20,000,000 RABBIT

10% of the distributed token will go towards funding development and expanding the team, and will be subject to the same two-year vesting as the token from the Community Pool Distribution.

Warchest Fund

5% of total supply,about 10,000,000 RABBIT.

5% of the distributed token is reserved for future strategic expenses. In the first month, 250,000 token were released for listing fees, auditing, third-party services, and liquidity of partners.

Community pool release program

RABBIT token will be released over two years with a decaying emissions schedule, and will be evenly distributed to the entire ecosystem as a community reward.

In total, there will be 159,500,000 RABBIT. To incentivize early adopters, there will be a bonus period, please keep updated via our telegram announcement. Below is our planned block reward schedule. Based on it, the circulating supply profile of RABBIT can be plotted.

Please note that the inflation rate drops off dramatically after the initial periods. In fact, the inflation rate will fall under 5% after 10 periods.

Launch Sequence

We will launch our services in the following sequence to ensure the smoothest experience for all users.

Bonus Period

Open deposit vaults & pancakeswap liquidity pool

- Users can start depositing their assets into our vaults

- We will seed PancakeSwap RABBIT-BNB so people can start acquiring Rabbit right away

- This phase is designed to make sure we have a healthy amount of assets for borrowing and liquidity for Rabbit trading for the next phase

To make sure we give everyone enough preparation time, we will start our rewards distribution on block xxxx,000 (approximately April 8th, 2021, 00.00 UTC time). Rabbit's allocation plan will be updated as follows:

- 52% distributed to liquidity providers for the RABBIT-BNB pool on PancakeSwap

- 48% distributed to lenders who deposit BNB or BUSD nd other token into our vaults — rewards will be divided equally between the pools

Official Operation Period

Levered yield farming launched, farmers can open leveraged yield-farming positions and get RABBIT reward.

- When we complete our smart contracts audits, we will open the leverage yield farming function, thus completing our service loop. Our current estimate for this is at the end of the April, 2021

- We will make a separate announcement in advance to the community before launching Phase 2

The reward period lasts about one week, after which the project officially starts, Rabbit's allocation plan will be updated as follows:

- 40% distributed to liquidity providers for the RABBIT- pool on PancakeSwap

- 25% distributed to lenders who deposit BNB or BUSD and other token into our vaults — rewards will be divided equally between the pools

- 35% distributed to users who have leveraged yield-farming positions opened — rewards will be calculated based on the loan amount; only leverage positions ( > 1x) will receive rewards

Pease note that the allocation percentages are subject to change. The team will monitor key metrics (pool utilization, lending APY, etc.) and if required, adjust the reward allocations to maintain the health of the platform.

Words in the End

From ordinary investors’perspective, there are high entry barriers to use traditional finance – it’s hard for borrowers to raise a loan, while the providers get low earnings. Rabbit is expected to solve this problem under the context of DeFi to give its users high earnings as well as increasing the liquidity of the fund. This is just one kind of benefit and change made by Rabbit Finance to investors. In the future finance world, Rabbit Finance will play a bigger constructive role.

For more information on this project you can view it below:

Websiet: http://rabbitfinance.io/

Whitepaper: https://app.gitbook.com/@rabbitfinance/s/homepage/

Twitter: https://twitter.com/FinanceRabbit

Telegram Group: https://t.me/RabbitFinanceEN

Github: https://github.com/RabbitFinanceProtocol

Discord: https://discord.gg/tWdtmzXS

Contracts: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/contract-information

Audit: https://app.gitbook.com/@rabbitfinance/s/homepage/resources/audit-report

Author:

Bitcointalk UserName : Alexandria viola

Bitcointalk Profil: https://bitcointalk.org/index.php?action=profile;u=2648222

Telegram Username : @AlexandriaViola

BEP-20 Address: 0x126bC28fe19CF8ed46351aCa0f469d9B79f06882

Komentar

Posting Komentar